What you will learn in this article:

Neobanks are a new breed of financial institutions that operate exclusively online, without physical branches. They leverage technology, particularly fintech, to offer a wide range of financial services through digital platforms such as mobile apps and websites. This digital-first approach allows neobanks to provide faster, more convenient, and often cheaper banking solutions.

Neobanks offer various financial products and services, including current accounts, savings accounts, debit and credit cards, loans, investments, and insurance.

The rise of neobanks represents a significant disruption in the traditional banking model, driven by several factors such as technological advancements, consumer trust and preferences, market demand, cost efficiency, and global expansion. Despite facing challenges such as building trust and navigating regulatory landscapes, neobanks are driving competition, prompting traditional banks to enhance their digital offerings.

As digital banking becomes the norm, embracing the convenience and innovation of neobanks will become increasingly important. The future of banking lies in their ability to deliver technology-driven, customer-focused financial services.

What are Neobanks?

Neobanks are a new breed of financial institutions that operate exclusively online, without physical branches. Unlike traditional banks, neobanks leverage technology, particularly fintech, to offer a wide range of financial services through digital platforms such as mobile apps and websites. This digital-first approach allows neobanks to provide faster, more convenient, and often cheaper banking solutions.

At the core of neobanks is the use of advanced technology and artificial intelligence to tailor financial services to meet the specific needs of their customers. This not only enhances customer satisfaction but also reduces operational costs. Neobanks offer various financial products and services, including current accounts, savings accounts, debit and credit cards, loans, investments, and insurance.

It is crucial to distinguish neobanks from digital banks. While digital banks are typically online subsidiaries of traditional banks, neobanks are independent entities that operate entirely online. They rely on third-party providers or partner banks for regulatory compliance and infrastructure, and they do not have physical branches, ATMs, or call centers.

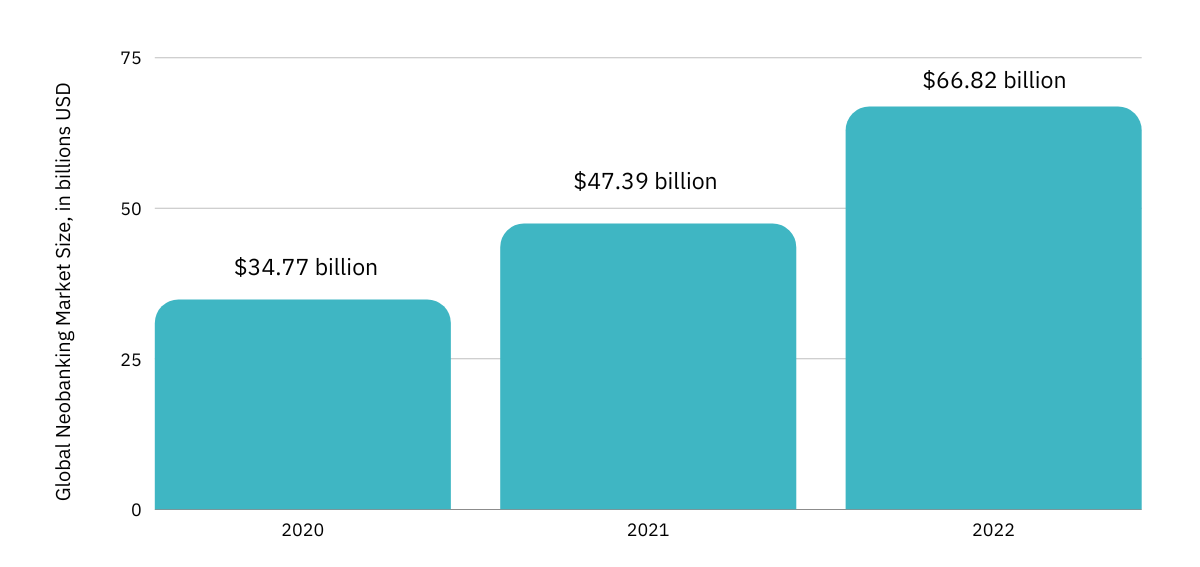

Source: Grand View Research

The Rise of Neobanks

The rise of neobanks represents a significant disruption in the traditional banking model, which has long been dominated by a few large financial institutions. This shift has been driven by several factors:

1. Technological Advancements

The advent of smartphones, cloud computing, and artificial intelligence has enabled the development of user-friendly and personalized banking experiences, paving the way for neobanks.

2. Consumer Trust and Preferences

The global financial crisis of 2008 eroded trust in traditional banks, prompting many consumers to seek alternative banking solutions. Neobanks have capitalized on this sentiment by offering innovative, transparent, and customer-centric services.

3. Market Demand

A tech-savvy younger generation, particularly those aged 18-34, has shown a strong preference for digital financial solutions. This demographic values convenience, speed, and low fees, all of which neobanks provide.

4. Cost Efficiency

By eliminating the overhead costs associated with physical branches, neobanks can offer lower fees and better interest rates. This cost efficiency is a significant advantage over traditional banks.

5. Global Expansion

Neobanks first gained traction in Europe with pioneers like Revolut, N26, and Starling Bank, and have since expanded to other regions, including North America, Asia, and Australia. Their success in these diverse markets underscores the universal appeal of digital-only banking.

“In five or six years, neobank customers are going to become 25% of the market. And then, once it’s 25%, neobanking is going to be very quickly ubiquitous.” *

* KATIE PAGENKOPF Practice Lead, Financial Services, Amdocs

Why Neobanks are Outpacing Traditional Banks?

Neobanks have revolutionized the traditional banking industry by placing a strong emphasis on customer-centricity. Unlike conventional banks, neobanks prioritize creating intuitive and user-friendly interfaces that simplify banking tasks. Features such as real-time notifications, spending insights, and budgeting tools empower customers to manage their finances more effectively. Additionally, neobanks have streamlined the account opening process, allowing customers to open an account within minutes without the need for physical paperwork or branch visits. This frictionless onboarding experience is a significant draw for customers who value convenience and efficiency.

One of the key factors behind the success of neobanks is their use of data analytics and artificial intelligence to offer personalized financial solutions. By analyzing customer spending patterns and behaviors, neobanks provide targeted recommendations for saving, investing, and budgeting. This level of personalization, previously unheard of in traditional banking, has garnered significant appreciation from customers.

Source: Grand View Research

Neobanks have also expanded access to banking services by lowering the barrier to entry. They can accept individuals who might not qualify for traditional bank accounts due to a lack of credit history or stable employment. This inclusivity, combined with their agility and ability to quickly respond to market trends and customer feedback, positions neobanks as leaders in the industry.

The rise of neobanks has compelled traditional banks to invest in digital transformation efforts to remain competitive. However, neobanks' agility and focus on customer experience give them a significant advantage over their conventional counterparts. Neobanks' overall convenience makes them an attractive alternative to traditional banks.

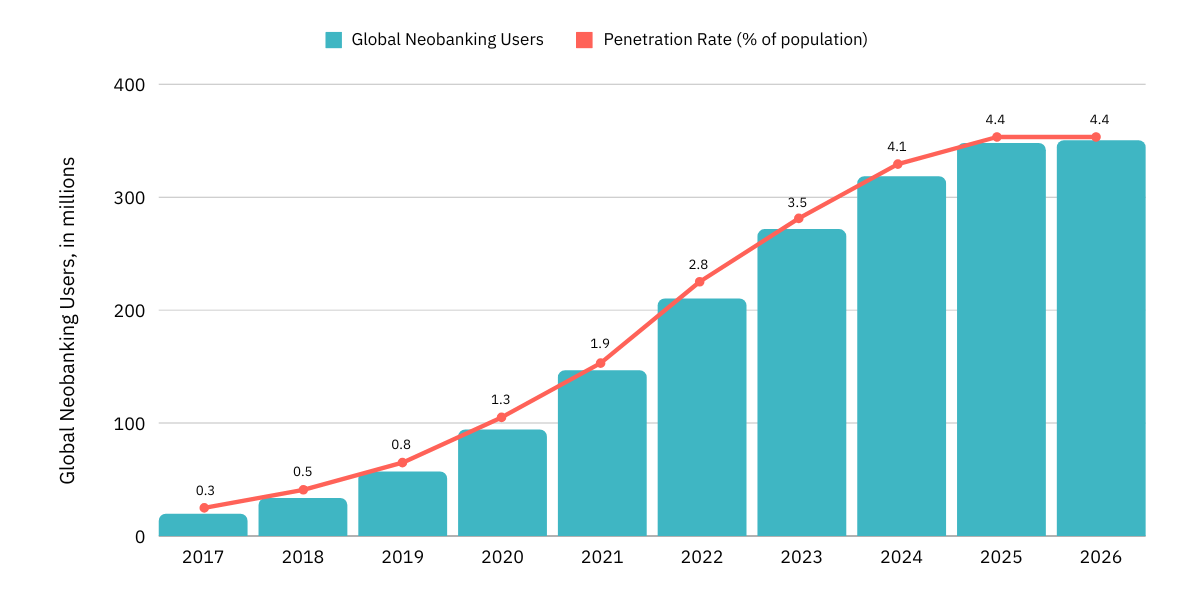

Source: Statista

Challenges and Risks Associated with Neobanks

Despite their rapid growth and innovative appeal, neobanks face several significant challenges and risks.

- Regulatory Compliance

Neobanks must adhere to stringent regulations to ensure the safety and security of customer funds, requiring significant investments in technology and compliance measures.

- Trust and Brand Recognition

Being new to the financial sector, neobanks lack the established credibility of traditional banks. Building brand awareness and gaining consumer trust are critical challenges.

- Cybersecurity & Vulnerability to Financial Crimes

As digital entities, neobanks are vulnerable to cyber threats and incidents like money laundering can damage their reputation. Ensuring robust security measures to protect customer data and transactions is essential to maintain trust.

- Customer Transition

Many consumers are hesitant to fully switch to digital banking due to security concerns, the need for physical financial products, and the unproven track record of neobanks.

In summary, while neobanks offer innovative and convenient banking solutions, they must navigate complex regulatory landscapes, build consumer trust, ensure robust cybersecurity, and compete in a crowded market to sustain their growth and success.

Neobanks could grow their revenues by 31% annually over the next five years, reaching $356 billion by 2026 *

* Accenture

The Path Ahead for Neobanks

The future of neobanks is bright as they continue to disrupt the traditional banking landscape. Traditional banks are increasingly adopting digital strategies, either by developing their own platforms or partnering with neobanks to harness their innovative technology. This shift is driving competition and innovation across the financial industry, ultimately benefiting consumers with improved services and more options.

Neobanks are also expanding their offerings beyond basic banking, venturing into areas like wealth management, lending, and insurance. This diversification allows them to deepen customer relationships and foster loyalty. As digital banking becomes more mainstream, neobanks are expected to continue growing and gaining market share, particularly by specializing in niche services that cater to specific customer segments.

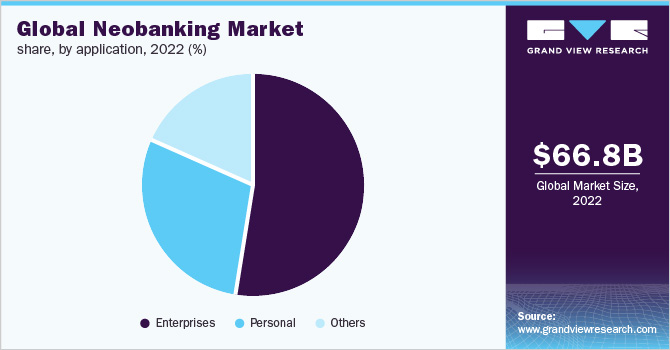

Source: Grand View Research

Conclusion: Embracing the Convenience and Innovation of Neobanks

Neobanks are revolutionizing the banking industry with their digital-first approach, offering innovative features and a strong customer-centric focus. They provide convenience, simplicity, and affordability, attracting tech-savvy consumers who value seamless user experiences and personalized financial solutions.

Despite facing challenges such as building trust and navigating regulatory landscapes, neobanks are driving competition, prompting traditional banks to enhance their digital offerings. As digital banking becomes the norm, embracing the convenience and innovation of neobanks will become increasingly important. The future of banking lies in their ability to deliver technology-driven, customer-focused financial services.